|

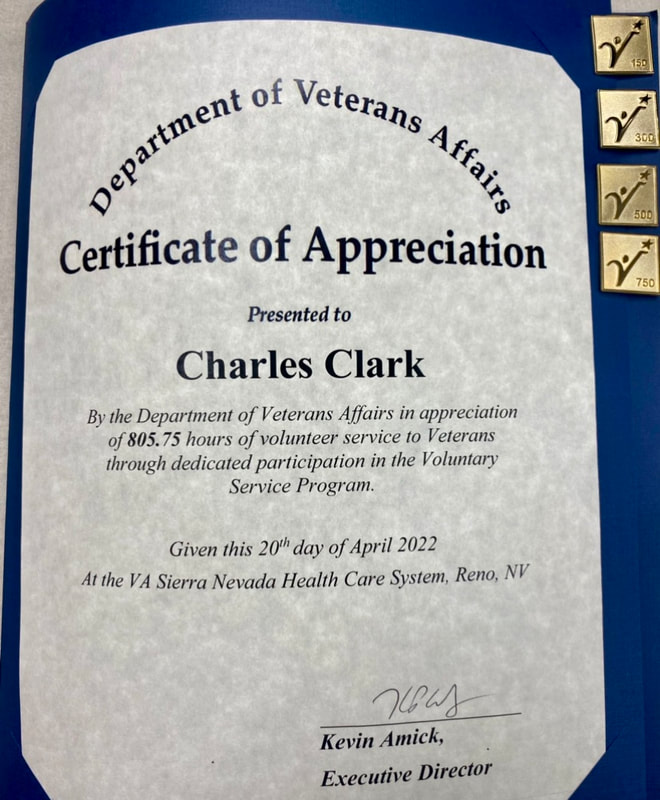

Join us in congratulating Cork for having just received his 750 hour pin from the Department of Veterans Affairs in Reno, NV! He reaches this amazing milestone with over 800 hours volunteered in service to our Veterans. That's equivalent to more than 33 full 24-hour days! Way to go, Cork!

Homesteads throughout Nevada have a lot of potential opportunities. The state’s primary cash crop is alfalfa hay. However, various other crops also grow well where irrigated, despite Nevada’s arid climate. These include potatoes, barley, winter and spring wheat, corn, oats, onions, garlic and honey. Raising livestock, however, is the primary way homesteaders and farmers can sustain themselves.

But what if you wanted to go beyond personal sustainability and create an income from your family homestead? The good news is that this is possible with a little hard work and determination. Clark Real Estate shares some insights. Legally Set Yourself Up for Business It isn't enough to want to create an income; you'll need to set yourself up for business legally. You may consider forming a limited liability company, which allows for several advantages when compared to other business types. Although you could use a lawyer, they come with a hefty price tag. Consider saving money by filing yourself or using a formation service. Each region has its own rules regarding the formation of a limited liability company, so be sure to research the regulations in your area before moving forward. Secure Funding for Expansion and Marketing There are a few options for funding your business. For example, you could take out a business loan, borrow from your personal savings, or ask for help from friends and family. If you plan on getting a loan, make sure your credit history is in order. However, one of the best ways to secure funding for your new agricultural business is through grants. Finding a grant you qualify for can be challenging and take time, but it's well worth it. A few tips to help you on your grant-funding journey include:

Market to Attract Customers Marketing your products to customers is crucial. It doesn't matter how great your local, organic honey or grass-fed beef is if nobody knows it exists. Take time developing a marketing strategy with a high return on investment (ROI) that doesn't stretch your resources too thin. If you're adding images to your marketing materials or communicating with a designer, consider compressing your JPG files to make them easier to email. However, be wary of compressors that degrade the quality of your files. Instead, use a JPG-to-PDF converter that will preserve your image's quality and allow you to convert several at once. Outsource Relevant Tasks to Save Time Numerous small businesses have turned to outsourcing certain tasks. It can be more affordable than hiring a part or full-time employee in some situations. Running a homestead and selling your agricultural products is a very hands-on business that doesn't seem to leave much room for remote workers. However, there are several tasks you could outsource. For example, you could outsource your website design, marketing, and content creation. You could even hire a virtual personal assistant to help organize and handle your online business. You can find freelancers for these positions on sites like Upwork and Freelancer. You Can Create an Income From Your Homestead If you want to go beyond self-sustainability and create an income from your homestead, it's possible. You just have to take the necessary steps to market your agricultural products and legally set yourself up for business. If you’re searching for a homestead property in the Reno area, reach out to the professionals at Clark Real Estate for all your real estate needs today!

It’s always best to enlist the help of reputable real estate professionals like Clark Real Estate who are intimately familiar with the area you’re moving to, as they will be able to avoid any unforeseen pitfalls in the process.

Start by getting to know your credit score. A score of at least 620, coupled with a low debt-to-income ratio, will help you get a better interest rate on the home of your dreams. Yahoo.com explains that you also need to make sure that you have enough money for a down payment and to make trips back and forth if you wish to visit your new home before you settle in. If you’re looking to save some money, and find an “as is” property, which is a home or condominium that the seller will not make repairs to. This can be a great way to reduce your overall expenses, but you’ll need to pay close attention to land records and hire a property inspector and an attorney to help you through the process. Know Your New Area If you’re moving with business as your number one priority, you probably are already fully familiar with the professional environment or the market. However, there are other things to consider as you make a move. If you have yet to find a position in a new job, you’ll want to take care of a few essentials before getting your name out there. One such essential is creating a stellar and professional-looking resume by utilizing a free resume builder that can be found online. You can choose from a library of professionally designed resume templates, and then add your own copy, photos, colors, and images. If you have kids, you’ll also want to research the school systems so you won’t run into any major snafus registering your children for classes. Also be aware of the housing market in the new area. The market in Northern Nevada and the Lake Tahoe area is quite competitive, and the Reno-Sparks Association of Realtors notes that it continues to be a strong seller’s market, so you’ll want to hit the ground running when you begin shopping for your new home. Get the Right Help In addition to having a realtor, you’ll also want to partner with a great moving company. Make sure you get plenty of quotes, and let your moving company know that you’re moving out of the country. You may get lucky and find someone offering discounts or special credits for people willing to move during the off-season. You’ll also want to partner with a property surveyor, which is especially important if your new home is outside of the planned residential neighborhood. Move Your Business When you find the perfect home in the perfect neighborhood, it’s time to ensure that your business can move seamlessly with you. The requirements for registering for an LLC varies state by state, so be sure to see what’s needed in Nevada. You can save on attorney fees by using a formation service online. You also want to make sure to update all of your contact information and, if applicable, physical location on your website and social media. Moving for a job is exciting. After all, that’s one good indication that you’re experiencing growth and forward momentum. However, there are many moving parts throughout the process, especially when your relocation takes you across state or country lines. The above info is great insight to have, but don’t forget to partner with experts that can keep you in check throughout the process. Let Clark Real Estate build and manage your Reno real estate portfolio. Team up with the Clark brothers today! (775) 828-3355 Image via Pexels Buying an investment property in Nevada is a financially wise decision. And not only because it's a valuable asset that can provide you with a significant passive income. On top of that, it can be a stress-free occupation. You can run a rental business any way that suits you. However, to ensure everything goes smoothly, it's better to choose the location carefully. Both local and long-distance landlords face different challenges and enjoy different benefits. Before you decide, it's best to consider both options. With that in mind, we've decided to examine both possibilities and help you make the right choice. So, local vs. long-distance investing: which is better for Nevada landlords? How to make the right decision? Firstly, before you start searching for the right property, you need to ask yourself a few questions. Knowing the answers will help you make up your mind and make a sound decision. So, ask yourself the following questions:

So, what are your financial goals? Do you want to get out of debt, gain independence, or accumulate wealth? To answer this question, you need to first assess your current finances. Then visualize where you want to be in the next five, ten, or twenty years. Knowing this will help you focus your investing in the right direction. Choose the right market Next, you need to decide on the right market. For example, you might want to have a high rent-to-value ratio. In that case, you should choose a cash-flow market that will provide you with valuable income. Or, if generating the cash flow isn't your priority, you might want to choose a market with a potential for long-term appreciation. Lastly, hybrid markets offer a mix of both options. Of course, what you decide on depends on your long-term goals. Self-management or using property management? To determine your real estate strategy, you need to answer this question. Maintaining the property and dealing with tenants can be pretty overwhelming at times. From the potential renovation of the property to tenants losing their keys for the n-th time, self-managing demands a lot of effort and work. However, some landowners prefer to be in charge and gladly take on these responsibilities. If that is the case with you, there is no dilemma. In local vs. long-distance, local investment property is a clear winner. On the other hand, if you'd rather hire a third party to manage your property, both options may work for you. In that case, the key is to find an experienced property management company you can rely on. Whether you choose a local or long-distance property, you'll be able to save both time and effort while they manage your rental business for you. Local investment property Now, let's have a closer look at what you can expect from buying a local investment property. Familiarity with the market The first and most obvious advantage is that you're more likely to be familiar with the market when you're investing locally. Every local market is unique, and knowing little flows and trends can help you invest in the right property. You'll know all the local attractions and amenities that are likely to attract tenants. However, doing proper research is still a must. You'll have more control This is crucial for many landlords in the local vs. long-distance dilemma. While it's not impossible to manage your property long-distance by yourself, it's certainly more demanding. On the other hand, you can choose a more hands-on approach as a local landlord. For example, you can meet with your tenants when necessary, show your property in person, and perform an inspection of the property. You can hire local contractors when necessary When you delve into investing in real estate, you're bound to need contractors at some point. Whether you want to remodel that fixer-upper or need some repairs, finding the right contractors locally is much more manageable. Firstly, you can choose them yourself and ensure they're suitable for the task. Secondly, they're less likely to try and take advantage of your absence. Long-distance investment property

However, long-distance investments also come with their own set of advantages and drawbacks. Let's have a proper look. A wider range of investment opportunities Depending on where you live, your local market might not be able to offer you what you want. What if you need cash flow but live in an appreciation market? On the other hand, if you don't limit yourself, you can opt for a more profitable market with a higher return on investment. If you find the right property in other parts of Nevada, you might even want to relocate there! If the business proves very lucrative, this might be an excellent idea. However, if you want to live nearby, ensure you plan your long-distance relocation with care. From packing your belongings to hiring trustworthy movers - many tasks will require your attention! Use a property management company Of course, you can do this on a local level, too. However, limiting yourself may lead to losing some excellent opportunities. And if you plan to hire property managers in either case, a long-distance investment can be a better choice. There are many reasons to hire property managers! Although it may seem a more expensive option at first, it can save you money in the long run. Especially if you don't have a lot of experience - they'll ensure your tenants are satisfied and your property in good condition. You can use your property for a variety of purposes While your goal is mainly to rent your property to tenants, you can also use it as a vacation home in between. Or, your kids can use it when they start college - no accommodation worries! And lastly, you might choose to relocate or retire there someday. The bottom line As you may see, there are many things landlords should consider when it comes to local vs. long-distance investing. Both options come with their unique advantages and issues. However, once you know your long-term goals and preferences, you'll be able to make the right choice. Meta description: Buying the right investment property is not an easy task. Find out which is better for landlords - local vs. long-distance investing! Hiring a professional to manage your investment property can take a considerable burden off your shoulders. You can still collect a profit from the rent without having to deal with the tenants or their issues. However, for things to run smoothly, it’s still important that you get along with the person managing your property. In this article, we will explain how to build a positive relationship with your property manager. Talk About Everything in Advance It’s very important to talk about and accurately define your expectations upfront so that there are no misunderstandings. In every human interaction, it’s very common for people to have unspoken expectations or take something for granted. However, when entering a professional relationship, it can be a huge mistake to leave any important topics unaddressed. Try to get everything in writing. The basis of any professional relationship is a signed contract. A legal document can help you outline the duties and responsibilities of the involved parties. The contract with your property manager will detail the fees you are obliged to pay the manager, as well as the exact services they will be providing for your Reno investment property. After the paperwork is out of the way, you can continue to build a positive relationship with your property manager, as neither of you will have to worry about the legal aspect of your professional interaction. Communication Is Key Some landlords don’t want to deal with their property at all, and that’s probably the main reason they hired a property manager in the first place. On the other hand, there are landlords who want to have a hands-on approach and constantly be kept in the loop about what’s going on with their property. While discussing how communication will function, you can also agree on how it will happen – are you going to talk over the phone or just through emails. Have a Plan to Deal With EmergenciesIt’s easy to build a positive relationship with your property manager when things are going fine. When there is no stress on the horizon, people generally tend to be relaxed, happy, and accommodating. However, in order to keep the relationship with your property manager functioning, you also need to have a protocol for dealing with stressful situations. Have a plan for dealing with:

Find a Property Manager You Are Comfortable WithEven before you start looking for a property manager, you should go through a brainstorming process. First of all, try to think of what your deal-breakers are and what you will instantly say no to. Meet the property manager in person and see if you like their attitude and overall demeanor. You can ask them for their references and about their previous experience. Get a property manager who has a good reputation and comes with a recommendation. Inquire about their management style and how they handle various issues that can occur. Think up possible problematic scenarios and ask the property manager what they would do in that situation. The best way to build a positive relationship with your property manager is to find someone you think you’d like to work with. What if You Are Not Living Near Your PropertyIt’s common to hire someone to manage your Reno property if you aren’t living there yourself. If you are the owner of a remote property, it will probably be difficult for you to visit and inspect it often. Therefore, it’s essential to build a positive relationship with your property manager that is based on trust. On the other hand, you could choose to relocate to be closer to your investment property. For example, if you currently live in Vegas, you could leave Las Vegas for good and move to Reno. This way, you could live nearby and easily handle any emergencies with your property. Connect on a Personal LevelAlthough you are paying the property manager for their services, and your relationship is on a professional basis – it’s still okay to ask your property manager a few personal questions and learn their story. For starters, it’s the polite thing to do. Consequently, if business is all you ever talk about, building a positive relationship with your property manager will be tough. You can also congratulate them when they manage to quickly resolve a problematic situation. After all, giving credit where credit is due is normal for any professional relationship, so why would you treat your property manager any different? As you can see, there aren’t really any secrets or tricks that will help you to build a positive relationship with your property manager. Base your relationship on mutual trust and respect, and get everything important defined as soon as you start working together. Preparation and forethought can save you a lot of stress in the long run. If you set things up correctly from the start, you could have an excellent professional relationship with your property manager that can last for a long time.

Photos used: https://www.pexels.com/photo/crop-businesspeople-making-deal-during-workday-5668517/ https://pixabay.com/photos/man-talking-on-the-phone-smartphone-1582238/ https://pixabay.com/photos/laptop-office-hand-writing-3196481/ https://www.pexels.com/photo/landscape-man-people-street-6357619/  When tenants are asked why they don't just buy a home, the answers often include, "my credit is bad." Improving your credit is not as hard as most people believe but it does take some action. Credit is established by a payment history. It is important to know what kind of payments are used to create a credit score. Some payments are not reported to the credit bureaus, but can be used as "non-traditional" forms of credit. These payments include cell phone, utilities and rent payments. If you have no credit score, these "non-traditional" payments can be used to prove your credit worthiness and are acceptable for certain home loan products. Keeping good records of these payments are important and can be the proof you need to qualify for financing. In the case of having poor credit due to slow payments on past loans such as a car payment or bills that were turned in for collection or repossession, that can still be overcome. The first step comes from learning what shows up on your credit report by having a bank pull a report and is willing to show you the results. If there are outstanding balances or collections, they must be addressed. It is possible that the creditors are willing to negotiate a payoff that is less than the actual amount you owe. Using a tax refund, for example, to pay off old debt would be a smart way to use those "extra dollars." A phone call to the creditor requesting a discount, in most cases, will result in a payoff that may be affordable and will be a step in improving your credit score. In any case, clearing any bad history is critical before any "good credit" can be obtained. If credit report shows only limited use of credit and the score is low, there is another way to correct this problem. Of course, the answer is to obtain recent payment history to show you now have the ability and willingness to make timely payments. One way to make this happen is to go to a bank or credit union and tell them what you are trying to do. Request a small loan of $1,000 or whatever the lender's minimum loan is. Use the loan proceeds to open a savings account or Certificate of Deposit to be held by the bank as security for the loan. The bank is 100% guaranteed that the loan will be repaid since they are holding the money to apply to the loan if you don't make the payments. Once the loan is in place, be sure to make timely payments until the loan is paid in full. The bank will then release the hold on the funds in your savings account. You will have accomplished two things: you improved your credit score, and you have money in the bank! Plus, the bank is now more willing to consider you as a risk for future loans. Building credit, or repairing credit is not an overnight thing, but is vital to making the leap from paying off someone else's mortgage to paying off your own.  While most folks are enjoying an increase in take home pay as a result of the TCJA (Tax Cuts and Jobs Act), understanding how the Act affects mortgage interest deductions is important. The legislation includes an increase of the standard deduction, which eliminates the need to claim the mortgage interest deduction at all for many tax payers. However, if your deductions exceed the standard amount ($12,000 for individuals and $24,000 for married couples filing jointly), you should be knowledgeable on what is allowable under the new rule. Here is a summary: 1. If your home loan was originated prior to January 1, 2018, and the loan was taken out to acquire, construct or substantially improve the home, the interest is still deductible. 2. Interest paid on Home Equity Loans are no longer deductible regardless of the origination date. 3. Interest on a mortgage taken out to refinance a previous loan will not be deductible. 4. The maximum mortgage amount allowed to deduct interest is $750,000. 5. If more than one house is owned and financed (for example; a lake home, ski home, country cabin, etc) only two can be used as mortgage interest deductions. So, if you have a primary residence with a mortgage and a second home with a mortgage and a third home with a mortgage, you can only count two of the properties as eligible for interest deduction. The properties selected can change from year to year which allows a home owner to choose the home loan with the highest interest rate to deduct. While this is not a comprehensive list of the changes, it should help in making a decision on whether to refinance or to purchase. There are different methods available for calculating the allowable deduction and it is advisable to consult a tax professional for specific advice regarding this issue.  Mortgage interest rates are on the rise. After enjoying a long break from higher rates, home buyers and homeowners are realizing the impact of even small changes in interest rates. True, rates are far from what could be considered high. (As a comparison, consider mortgage rates in 1982-83 being over 16%.) Currently, every $1,000 of financing a 30 year mortgage costs only about $5 per month. Here's what that means: If your budget allows for a monthly mortgage payment of $1,000 (not counting escrows for property taxes or insurance, PMI or HOA dues) that equates to a $200,000 loan. If interest rates continue to rise as experts predict, even a 1% increase in rates reduces that $1,000 monthly payment to about $178,000 in financing. That's a difference of about 11% less buying power! That could mean the difference between the home of your dreams and one you will settle for. History shows that housing market activity actually goes up when rates increase. The reason? Buyers realize they may miss out on getting the house they want with the payment they can afford. That results in a higher number of buyers looking at the same time. This drives up prices as more homes are sold with multiple offers. There are some steps borrowers can take to improve their situation in a rising interest rate market: 1. Get pre-approved by a lender with competitive rates and a reputation of being able to move a loan from purchase to closing in a timely manner. 2. Pull together all the information your lender will need before you get together with them. This will include:

4. Be prepared to address any negative items that may be on your credit history. Having these items in advance will speed up the approval process significantly and give you an advantage in being able to move quickly when the right house becomes available. Finally, discuss "locking" the interest rate with your lender. In a rising rate market, it is critical to understand the lender's policy to lock in a rate to protect you from changes that could occur prior to the closing of your loan. Typically interest rates cannot be locked until you have a purchase agreement signed by all parties and you have confidence in the closing date as well as having resolved any contingencies such as house inspections. While rates are rising, it's still an excellent time to invest in real estate. Taking advantage of today's rates will make you look like a genius in the future and you will have locked in a stable payment for a long time to come. Cork and Rick Clark grew up in Reno, Nevada watching their father build and invest in real estate. They felt very fortunate to not only enjoy the direct benefits but also for the opportunity to learn about real estate investing.

"He paved the way and showed us the financial rewards," Rick shares, "Pops taught us the importance of a strong work ethic. If you want to be successful, you need to be on the job everyday." The Clark family motto if we are going to reach a particular goal, you MUST be consistent by being on the job and working diligently everyday got the brothers through the 2008 crash, and lead their property management company into record-breaking growth and momentum. Cork and Rick have used their knowledge of real estate and expertise in construction along with their unwillingness to sit still to build Clark Real Estate to over 700+ doors (households) under management. Their favorite part of managing properties and real estate investments is that every day is different, every project is different, every house is different. They get to problem-solve every day--either from the office or out at a construction site. Their father and uncle, now in their 80s, modeled how to successfully work as brothers, and they have enjoyed working as a team. "Knowing somebody's got my back and that we have the same goals is the best part about working with my brother," Cork says. Rick is the second of seven children, and Cork is the younger brother as the fifth child. The Clark brothers got started in real estate investing and property management by way of the construction industry. They had been in the construction industry since they were teenagers. With the construction experience "we could visualize firsthand all the possibilities," Rick says. "We would look for the biggest problem property in a neighborhood," remembers Rick, "we would make offers on properties that weren't for sale." It wasn't long and the brothers had a handful of renovated properties that now needed to be managed. They started a property management company and took on leasing and maintenance for other real estate investors. "No one knows the community better than we do. We're lifers," Rick smiles. "We're hands on. We've started from the ground up. There are very few aspects of the real estate and investing game that we have not experienced first-hand," adds Cork. Clark Real Estate brings drive and enthusiasm to folks looking to invest in the Reno area. Would you like to see their Map for building your real estate investment portfolio? |

Clark Real Estate

305 W. Moana Ste C Reno, NV 89509 (775) 828-3355 Reno Property Management

All

|

RSS Feed

RSS Feed