|

Furnished vs. unfurnished rental: the ultimate pros and cons guide. Find out which option can maximize your returns. Welcome, landlords and property owners, to the ultimate showdown between two rental property titans: furnished vs. unfurnished rental. If you've ever found yourself pondering over the decision of whether to deck out your rental with stylish furniture or leave it as a blank canvas, you've come to the right place. Choosing between these two options can have a significant impact on your bottom line and the type of tenants you attract. Picture this: a furnished rental that exudes luxury and convenience, attracting young professionals and short-term renters willing to pay top dollar. On the other hand, an unfurnished rental, a blank canvas that allows tenants to unleash their inner interior designer, is potentially appealing to long-term tenants seeking a place to call home sweet home. We're here to break down the pros and cons of each option, helping you make an informed decision that aligns with your goals as a savvy landlord. The Pros and Cons of Furnishing Your Rental Just imagine the oohs and aahs from potential tenants as they step into your stylishly appointed abode. But is furnishing your rental truly worth the investment? Let's explore the pros and cons and see if this path to rental glory is right for you. Pros of Furnished Rentals

Cons of Furnished Rentals

Pros of Unfurnished Rentals

Cons of Unfurnished Rentals

Factors to Consider When deliberating on furnished vs. unfurnished rental, several factors come into play. First, consider the location and target market of your property. Are you in a bustling city center catering to young professionals or a suburban area attracting families? Next, research rental rates and market demand in your area. Compare the potential income from furnished rentals against the long-term stability of unfurnished options. The size and type of property also matter. Small studio apartments may benefit from being furnished, while larger homes might be better suited for unfurnished rentals. Think about the rental duration you're targeting. Short-term tenants may prefer furnished rentals, while long-term tenants often appreciate the freedom to bring their own furniture. Finally, consider maintenance and management. Furnished rentals require more hands-on management, while unfurnished rentals typically involve less maintenance and allow tenants to take responsibility for their furnishings. Photos via: Unsplash Unsplash Unsplash Unsplash Learn what questions to ask your prospective tenant’s references in order to find the best tenant for your rental that won't cause trouble down the line! Choosing to let someone live in your rental is always a risk. If they cause considerable property damage, then you’ll definitely fail to turn a profit. In order to avoid this, it’s important to know what questions to ask your prospective tenant’s references. Do they have any pets or bad habits? The very first of the questions to ask your prospective tenant’s references is whether they have any pets or bad habits. This is a question you can very easily slot into the conversation, whether you got a personal reference, a work reference, or a reference to one of their previous landlords. The latter, of course, will provide the most reliable information. This is especially important if you are renting to tenants with kids since they can be tempted to try to work around your ban on pets by hiding them from you. Are they violent or cause problems? This is another one of the questions to ask your prospective tenant’s references, irrespective of who they are. Friends and family will hesitate to say anything negative about them, but even their hesitation reveals a lot. Naturally, if their boss or previous landlord does reveal a tendency for problematic behavior, you should immediately give up on leasing out your rental to them! Even if they claim the person has changed since then, there’s a chance that they’ll revert to their previous behavior. And you do not want to risk your rental in this manner. What’s their social life like? While it may seem like an odd or innocuous question, this is very important. You need to know whether your tenant will feel compelled to organize parties or large social gatherings. While they are not an issue per se, frequent parties or too much alcohol can still lead to serious damage being inflicted on your property. And, if you are renting to roommates, it is doubly sure to check both of their references for this potential pitfall. When people room together, the scale of the social gatherings can grow and increase the potential for your rental to get damaged. Do they make their payments on time? This is a question you need to ask the landlords listed on your potential tenant’s references. Their rent payment history immediately reveals whether you will have problems with getting your payments regularly. Of course, some allowances should be made. Running late once or twice over a period of five or six years is more than okay. But, if they have a tendency to run late often, or ask for frequent extensions, then your own budgeting suffers. You won’t be able to rely on their payments, and that might not be something you want to deal with. What can you tell me about their personality? This is a question you want to ask the employer or landlord of your potential tenant more so than their friends or family. Family or friends tend to view problematic personality traits far more leniently than they should. A former landlord, however, can attest to the quality of their character more reliably. You do not want to rent out your property to someone confrontational. Or someone who makes an issue out of everything. Once a lease has been signed, you are more or less stuck with them, so make sure they have a personality you can stand for the duration of the lease. Did they take care of the rental properly? This is perhaps one of the most important questions to ask your prospective tenant’s references. Of course, the only ones who can attest to this are their past landlords. If they haven’t had a previous landlord, and you have their parents as one of the references, you should ask them about the condition of their room at home. The question may seem humorous, but if answered honestly, it can give you a lot of information. Failing that, you can always ask about their tidiness and cleanliness at work. This, too, can provide you with some insight into how they’ll treat your rental. Were there any unexpected issues? We have here another question aimed at former landlords. If they ask for clarification, you can ask if any repairs were suddenly needed due to damage inflicted by the tenant. Some damage can be accidental, such as stains or scratches. However, if they’ve broken an appliance or a piece of furniture, it can hint at something worse, even if it was carefully disguised as an accident. If they have a history of breaking things, you probably want to remove your better furniture and decorative pieces. As the experts from hansenbros.com love to point out, they can stay safe in storage for as long as needed. Did your other tenants have any complaints about them? One of the best ways to gauge whether a tenant will be problematic is to ask about the complaints of their neighbors. If their former landlord or neighbor can attest that there were no problems, you can rest assured. If there were a qualified property manager looking after the rentals, they’d also be able to provide a lot of pertinent information on this subject. However, you probably don’t want a combative tenant who might disrupt the lives of your other tenants on your property. Would you let them lease your rental again?

The final of the questions to ask your prospective tenant’s references, if they’re a landlord, of course, is whether they would let them live in their rental again. There is no better way to check whether you want to let them lease out your property. If the answer is no, then even if they’d offered nothing but praise for the tenant previously, you can be assured there was something they’d held back. Carefully selecting the right tenant for you By using the questions to ask your prospective tenant’s references well, you’ll be able to find the perfect tenant for your rental! What ‘perfect’ means is different from landlord to landlord, of course. So, make sure to throw in any additional questions you believe are important to you! Picture Links: Unsplash Unsplash Unsplash Unsplash Buying an investment property in Nevada is a financially wise decision. And not only because it's a valuable asset that can provide you with a significant passive income. On top of that, it can be a stress-free occupation. You can run a rental business any way that suits you. However, to ensure everything goes smoothly, it's better to choose the location carefully. Both local and long-distance landlords face different challenges and enjoy different benefits. Before you decide, it's best to consider both options. With that in mind, we've decided to examine both possibilities and help you make the right choice. So, local vs. long-distance investing: which is better for Nevada landlords? How to make the right decision? Firstly, before you start searching for the right property, you need to ask yourself a few questions. Knowing the answers will help you make up your mind and make a sound decision. So, ask yourself the following questions:

So, what are your financial goals? Do you want to get out of debt, gain independence, or accumulate wealth? To answer this question, you need to first assess your current finances. Then visualize where you want to be in the next five, ten, or twenty years. Knowing this will help you focus your investing in the right direction. Choose the right market Next, you need to decide on the right market. For example, you might want to have a high rent-to-value ratio. In that case, you should choose a cash-flow market that will provide you with valuable income. Or, if generating the cash flow isn't your priority, you might want to choose a market with a potential for long-term appreciation. Lastly, hybrid markets offer a mix of both options. Of course, what you decide on depends on your long-term goals. Self-management or using property management? To determine your real estate strategy, you need to answer this question. Maintaining the property and dealing with tenants can be pretty overwhelming at times. From the potential renovation of the property to tenants losing their keys for the n-th time, self-managing demands a lot of effort and work. However, some landowners prefer to be in charge and gladly take on these responsibilities. If that is the case with you, there is no dilemma. In local vs. long-distance, local investment property is a clear winner. On the other hand, if you'd rather hire a third party to manage your property, both options may work for you. In that case, the key is to find an experienced property management company you can rely on. Whether you choose a local or long-distance property, you'll be able to save both time and effort while they manage your rental business for you. Local investment property Now, let's have a closer look at what you can expect from buying a local investment property. Familiarity with the market The first and most obvious advantage is that you're more likely to be familiar with the market when you're investing locally. Every local market is unique, and knowing little flows and trends can help you invest in the right property. You'll know all the local attractions and amenities that are likely to attract tenants. However, doing proper research is still a must. You'll have more control This is crucial for many landlords in the local vs. long-distance dilemma. While it's not impossible to manage your property long-distance by yourself, it's certainly more demanding. On the other hand, you can choose a more hands-on approach as a local landlord. For example, you can meet with your tenants when necessary, show your property in person, and perform an inspection of the property. You can hire local contractors when necessary When you delve into investing in real estate, you're bound to need contractors at some point. Whether you want to remodel that fixer-upper or need some repairs, finding the right contractors locally is much more manageable. Firstly, you can choose them yourself and ensure they're suitable for the task. Secondly, they're less likely to try and take advantage of your absence. Long-distance investment property

However, long-distance investments also come with their own set of advantages and drawbacks. Let's have a proper look. A wider range of investment opportunities Depending on where you live, your local market might not be able to offer you what you want. What if you need cash flow but live in an appreciation market? On the other hand, if you don't limit yourself, you can opt for a more profitable market with a higher return on investment. If you find the right property in other parts of Nevada, you might even want to relocate there! If the business proves very lucrative, this might be an excellent idea. However, if you want to live nearby, ensure you plan your long-distance relocation with care. From packing your belongings to hiring trustworthy movers - many tasks will require your attention! Use a property management company Of course, you can do this on a local level, too. However, limiting yourself may lead to losing some excellent opportunities. And if you plan to hire property managers in either case, a long-distance investment can be a better choice. There are many reasons to hire property managers! Although it may seem a more expensive option at first, it can save you money in the long run. Especially if you don't have a lot of experience - they'll ensure your tenants are satisfied and your property in good condition. You can use your property for a variety of purposes While your goal is mainly to rent your property to tenants, you can also use it as a vacation home in between. Or, your kids can use it when they start college - no accommodation worries! And lastly, you might choose to relocate or retire there someday. The bottom line As you may see, there are many things landlords should consider when it comes to local vs. long-distance investing. Both options come with their unique advantages and issues. However, once you know your long-term goals and preferences, you'll be able to make the right choice. Meta description: Buying the right investment property is not an easy task. Find out which is better for landlords - local vs. long-distance investing! Clark Real Estate, Investments and Property Management offers a few fun tips for reaching your health, wealth and happiness goals for the New Year by making a few adjustments with your home!

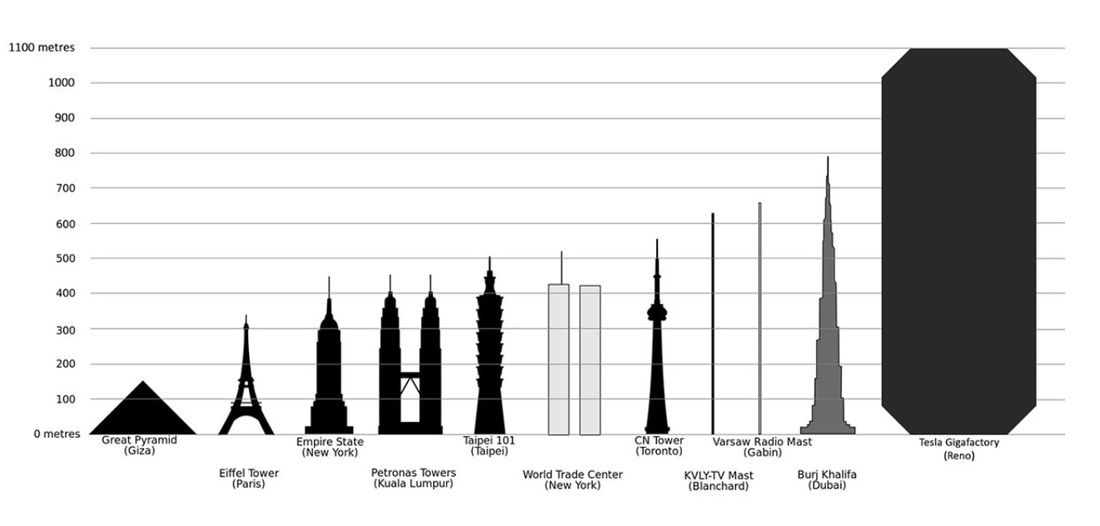

1. Clear the Distractions: Have you ever noticed you get a boost of creativity or physical energy when you go on vacation? What if it's not because of the long day at the beach, but because of the clutter-free hotel room? The beds are made, the floor is clean, none of the usual paperwork is laying around. You're free to think and move about! When you make plans, you can go do it--without tripping over your kid's homework or frantically searching the house for something to wear. What if your home always functioned this way? Start with one distracting room or closet, and rethink it like you're going on vacation: If I was going on a 30 day trip, which items would I need to take with me? Pull those few items, and then move the rest. You can experiment by packing unnecessary items in your suitcase or in a distant closet or the garage to see if life is more enjoyable without the clutter. Or just move the items out of your every day line of sight. If you're feeling extremely bold and are ready for a complete change in your life, donate items to a Shelter or Thrift Store. Continue to go through each room of your home each week or month. The more you clear, the easier it will be--as you'll start to feel the positive effects of a distraction-free home. 2. Live in your Investment: Robert Kiyosaki (Author of Rich Dad, Poor Dad) talks about how your home is a liability, because you're spending more on it than you're making from it. Many Americans assume that because their home may be increasing in value, it's automatically a good investment. Unfortunately, the math doesn't quite work that way! The Reno area is in an exciting growth period, and those who have invested in rental properties are going to be reaching those Wealth Resolutions sooner rather than later. You can turn your home into an investment by finding a way to make money from it. Hrmm, how? If you own your home, you're free to rent out a room, or even your garage as a storage space. Tools like AirBnB allow everyday homeowners to make some extra income from their empty guest room or den. If you're not comfortable with sharing your space, let's schedule a consultation to review the possibilities of purchasing your own income-generating property. If you're renting the home you live in, there may be ways to generate income from it, as well. Please be sure to run any ideas by our office to ensure it is in compliance with your lease agreement! Please feel free to call us when you're debating remodeling projects; we can help determine which projects will return the most value down the road if you choose to sell or rent out your home. 3. Tune In: Take a day to just observe your thoughts and feelings when you wake up, walk through your home, leave the driveway, and return. What parts of your home made you smile? What was frustrating? What can you fix, and what can you let go of? When our homes are in disrepair for extended periods of time, it can negatively affect our day, and wreak havoc on the property. Is there a strange smell in the cupboard? A crack in the wall? A dim light bulb? Let's get those things addressed right away! If you're just feeling resentment toward your home, it might not be a maintenance issue, it might be time to upgrade! We are here to connect the right tenants with the right properties, and the right investors with the right investment properties. If you are feeling unsatisfied with your home, let's talk! We have a growing inventory of options just for you! Let's start with the scope of things. Just how much could the Tesla Gigafactory ignite Reno's economy and housing market? Here we see why they don't call it a factory, but a gigafactory: Let's just talk in terms of physical size. What does a structure that size do to an economy? It brings immediate jobs in the construction of the structure, it maintains jobs as a whole workforce is needed to run that place, and then it brings tourists--because Reno is now on the map and has one of the wonders of the world (so to speak!). So what does that mean for your real estate investment portfolio? If you have any real estate in the Reno area, hold it. Now is not the time to sell, unless you're converting up into more units. If your properties are frustrating and not bringing in a profit, consult one of our property agents. We are happy to give you some pointers on making your investment a success. If you don't have any real estate in the Reno area, let's get started. The Tesla Gigafactory is scheduled to bring in 6500 jobs ranging from lower-level manufacturing to higher-level engineering and technology. That means a range of incomes and housing needs. Rental Properties: Just about ANY rental properties will be a good investment at this time. Look for properties close to major highways, and units that cover their cost today, with the ability to improve and raise the rents in the future. Fix and Hold and Flip Properties: Nevada mandated that at least half of the workforce at the Tesla gigafactory needs to be Nevada residents. The other half will need a place to call home! Assume that much of the other half will be higher level engineers, scientists and inventors. While Reno is striving to offer the best in Sciences and Engineering education, the Tesla factory will need the best of the best in 5-6 years. Look at properties with that timeline in mind. What improvements can be made to a property with a 5 year budget, and with a tenant in place for much of that time? Look for neighborhoods with artists and innovators; neighborhoods that are just starting to show improvement is where you'll find the bargains. Start your improvements on the exterior of the property to further advance the revitalization of the neighborhood. Property Management: Let the professionals do the day-to-day maintenance and management of your property. It is going to take 5-10 years before we experience the influx of revenue and jobs that Tesla promises. If you are living out of state, there's no reason to take on the hassle of managing your new Reno real estate. With a 5-10 year timeline, it's time to get comfortable, and we can help! With our proven track record of filling vacancies and maintaining properties, Clark Real Estate can turn your real estate investing dream into a reality. “The present is theirs; the future, for which I really worked, is mine.”

― Nikola Tesla There's a spark, a current, of electricity and excitement in the Reno air as business owners and property owners imagine the possibility of the Tesla Gigafactory coming to town. There is much discussion about state-offered incentives and benefits. Will it be approved? Will the benefits be worth it?

We think so. In real estate we see the value of new businesses infiltrating a city. We see how home values go up as the supply of inventory is more in demand. Further, we see how new companies bring in new revenue, that is spent in local restaurants, boutiques and salons. New money helps the local economy, and new people bring a sort of awakening to a community. We've noticed how new energy invigorates a neighborhood. New and improved landscaping, fencing and front doors suddenly dot a once rundown street. At Clark Real Estate, we are excited about the possibilities of co-branding with the legendary Tesla. Nikola Tesla* was an underdog who never gave up on his dreams. Reno has been coined an underdog, and now it doesn't have any excuses to give up on a brighter future. Engineer and physicist Nikola Tesla (1856-1943) made dozens of breakthroughs in the production, transmission and application of electric power. He invented the first alternating current (AC) motor and developed AC generation and transmission technology. Though he was famous and respected, he was never able to translate his copious inventions into long-term financial success—unlike his early employer and chief rival, Thomas Edison. [History.com] Clark Real Estate offers Sparks and Reno property management services for landlords and homeowners out of state and out of town. Maximize your investment dollars by investing in Reno/Sparks! Keep enjoying the Southern California lifestyle, while we take care of your money-maker in Northern Nevada! When I bought my first home in Sparks, NV, I didn't realize I would be moving to Southern California. In the first quarter of 2014, Clark Real Estate and Investments exceeded its 400 rental unit mark. Brothers Cork and Rick are excited to continue the legacy, now third generation owners. A powerful team has been working to fill rentals, find new houses, and assist investors in the purchasing process. The Clark Real Estate team is shooting to reach 500 units by 2015.

Reno, NV, May 27, 2014 --(PR.com)-- In the first quarter of 2014, Clark Real Estate and Investments of Reno, NV exceeded its 400 rental unit mark. The company manages over 400 properties with a record low vacancy rate. Brothers Cork and Rick Clark are excited to continue the legacy of real estate investment and property management, now third generation owners. The brothers have been helping with the family business since they were kids, working during the summer. "Growing up within a family of real estate investors, contractors and plumbers, has given me a very diversified and complete understanding of what our clients expect," says Cork. The company focuses on building trust with both their tenants and landlords. “The philosophy is simple: we treat each unit as if it were our own,” notes Kristin Gandolfo, property manager. The Reno/Sparks real estate market was hit hard in the recession, but with an excessive inventory of properties and an influx of tenants (ex-homeowners) the rental market is growing faster than ever. According to the US Census, 52.3% of Reno residents are renting their homes. A powerful team at Clark Real Estate has been working to fill rentals, find new houses, and assist investors in the purchasing process. The Clark Real Estate team is shooting to reach 500 units by 2015. "Honestly, at this point, we just need more units because we don't want to turn away any quality tenants," Rick explains. The team works aggressively with tenants to find the right home, or with owners to find the right tenant. “Just tell me what kind of place you want, and I’ll go find it for you,” says Isaac Conde, property manager. Conde looks beyond the current inventory at Clark Real Estate, confident that he can turn the property of a tenant’s choosing into an addition to the Clark collection. With a proven track-record Clark Real Estate and Investments is confident that they will continue to hit their inventory milestones. |

Clark Real Estate

305 W. Moana Ste C Reno, NV 89509 (775) 828-3355 Reno Property Management

All

|

RSS Feed

RSS Feed