|

Cork and Rick Clark grew up in Reno, Nevada watching their father build and invest in real estate. They felt very fortunate to not only enjoy the direct benefits but also for the opportunity to learn about real estate investing.

"He paved the way and showed us the financial rewards," Rick shares, "Pops taught us the importance of a strong work ethic. If you want to be successful, you need to be on the job everyday." The Clark family motto if we are going to reach a particular goal, you MUST be consistent by being on the job and working diligently everyday got the brothers through the 2008 crash, and lead their property management company into record-breaking growth and momentum. Cork and Rick have used their knowledge of real estate and expertise in construction along with their unwillingness to sit still to build Clark Real Estate to over 700+ doors (households) under management. Their favorite part of managing properties and real estate investments is that every day is different, every project is different, every house is different. They get to problem-solve every day--either from the office or out at a construction site. Their father and uncle, now in their 80s, modeled how to successfully work as brothers, and they have enjoyed working as a team. "Knowing somebody's got my back and that we have the same goals is the best part about working with my brother," Cork says. Rick is the second of seven children, and Cork is the younger brother as the fifth child. The Clark brothers got started in real estate investing and property management by way of the construction industry. They had been in the construction industry since they were teenagers. With the construction experience "we could visualize firsthand all the possibilities," Rick says. "We would look for the biggest problem property in a neighborhood," remembers Rick, "we would make offers on properties that weren't for sale." It wasn't long and the brothers had a handful of renovated properties that now needed to be managed. They started a property management company and took on leasing and maintenance for other real estate investors. "No one knows the community better than we do. We're lifers," Rick smiles. "We're hands on. We've started from the ground up. There are very few aspects of the real estate and investing game that we have not experienced first-hand," adds Cork. Clark Real Estate brings drive and enthusiasm to folks looking to invest in the Reno area. Would you like to see their Map for building your real estate investment portfolio? With Valentine's Day just a heartbeat away, now is the time to think about those traditional themes of loved ones, property management, and real estate. Well ok, maybe these three topics aren't routinely considered all at the same time, but why shouldn't they be? After loved ones, real estate and homes are things in life that are pretty high up on everyone's priority list - so let's take a 'seasonal' look at how they might be related to each other.

Love yourself with real estate investment A few ways that someone might pamper himself or herself to show a little self-love is to buy a new set of golf clubs, schedule a relaxing massage for those aching muscles, or perhaps go a bit further out on the limb and buy that alluring new new sports car. While all those are wonderful perks to contemplate, none of them - even the car - has the permanence or the deep inner satisfaction that an investment in real estate brings. And even better - the security and the value that real estate returns to you is very much like being loved back. Love your spouse with your real estate investment There might not be a better way in the world to express your love to a spouse than with a real estate investment. Sure, some people might object and suggest diamonds or other jewelry as the supreme expression of caring, but jewelry usually ends up stowed away in a box somewhere, only to be retrieved for special occasions. An investment in a home is something that surrounds your spouse every day with the warmth and depth of your feeling, and for any other kind of property, it still represents a long-lasting commitment to him or her that cannot fail to impress with its own unique permanence. The steamy side of love and real estate You could do the expected and arrange for a fancy date to celebrate Valentine's Day with your spouse or loved one, but you've probably done something like that already, if not many times before. This year, impress him or her with something completely different, and earn major kudos for originality. Why not stay at home this time around and celebrate the day for lovers by discussing some of the red-hot topics of real estate and property management? Try nibbling on your lover's ear while whispering the latest market statistics on average prices and absorption rates. If that doesn't reduce him/her to quivering jello, a candlelit dinner with breathy exchanges on amortization schedules is sure to do the trick. And if these two don't quite provide the spice you'd hoped for, you may have to bring out the heavy artillery. Slip in that video on urban sprawl and tax assessments while giving a slow, sensuous foot massage - it just might be the most memorable Valentine's Day you ever share with your loved one. Clark Real Estate, Investments and Property Management offers a few fun tips for reaching your health, wealth and happiness goals for the New Year by making a few adjustments with your home!

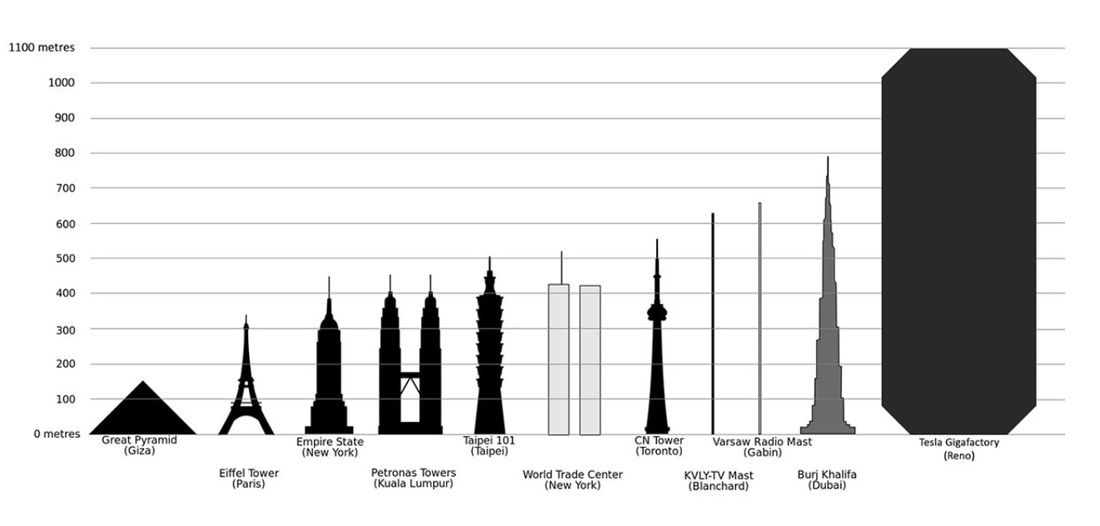

1. Clear the Distractions: Have you ever noticed you get a boost of creativity or physical energy when you go on vacation? What if it's not because of the long day at the beach, but because of the clutter-free hotel room? The beds are made, the floor is clean, none of the usual paperwork is laying around. You're free to think and move about! When you make plans, you can go do it--without tripping over your kid's homework or frantically searching the house for something to wear. What if your home always functioned this way? Start with one distracting room or closet, and rethink it like you're going on vacation: If I was going on a 30 day trip, which items would I need to take with me? Pull those few items, and then move the rest. You can experiment by packing unnecessary items in your suitcase or in a distant closet or the garage to see if life is more enjoyable without the clutter. Or just move the items out of your every day line of sight. If you're feeling extremely bold and are ready for a complete change in your life, donate items to a Shelter or Thrift Store. Continue to go through each room of your home each week or month. The more you clear, the easier it will be--as you'll start to feel the positive effects of a distraction-free home. 2. Live in your Investment: Robert Kiyosaki (Author of Rich Dad, Poor Dad) talks about how your home is a liability, because you're spending more on it than you're making from it. Many Americans assume that because their home may be increasing in value, it's automatically a good investment. Unfortunately, the math doesn't quite work that way! The Reno area is in an exciting growth period, and those who have invested in rental properties are going to be reaching those Wealth Resolutions sooner rather than later. You can turn your home into an investment by finding a way to make money from it. Hrmm, how? If you own your home, you're free to rent out a room, or even your garage as a storage space. Tools like AirBnB allow everyday homeowners to make some extra income from their empty guest room or den. If you're not comfortable with sharing your space, let's schedule a consultation to review the possibilities of purchasing your own income-generating property. If you're renting the home you live in, there may be ways to generate income from it, as well. Please be sure to run any ideas by our office to ensure it is in compliance with your lease agreement! Please feel free to call us when you're debating remodeling projects; we can help determine which projects will return the most value down the road if you choose to sell or rent out your home. 3. Tune In: Take a day to just observe your thoughts and feelings when you wake up, walk through your home, leave the driveway, and return. What parts of your home made you smile? What was frustrating? What can you fix, and what can you let go of? When our homes are in disrepair for extended periods of time, it can negatively affect our day, and wreak havoc on the property. Is there a strange smell in the cupboard? A crack in the wall? A dim light bulb? Let's get those things addressed right away! If you're just feeling resentment toward your home, it might not be a maintenance issue, it might be time to upgrade! We are here to connect the right tenants with the right properties, and the right investors with the right investment properties. If you are feeling unsatisfied with your home, let's talk! We have a growing inventory of options just for you! Let's start with the scope of things. Just how much could the Tesla Gigafactory ignite Reno's economy and housing market? Here we see why they don't call it a factory, but a gigafactory: Let's just talk in terms of physical size. What does a structure that size do to an economy? It brings immediate jobs in the construction of the structure, it maintains jobs as a whole workforce is needed to run that place, and then it brings tourists--because Reno is now on the map and has one of the wonders of the world (so to speak!). So what does that mean for your real estate investment portfolio? If you have any real estate in the Reno area, hold it. Now is not the time to sell, unless you're converting up into more units. If your properties are frustrating and not bringing in a profit, consult one of our property agents. We are happy to give you some pointers on making your investment a success. If you don't have any real estate in the Reno area, let's get started. The Tesla Gigafactory is scheduled to bring in 6500 jobs ranging from lower-level manufacturing to higher-level engineering and technology. That means a range of incomes and housing needs. Rental Properties: Just about ANY rental properties will be a good investment at this time. Look for properties close to major highways, and units that cover their cost today, with the ability to improve and raise the rents in the future. Fix and Hold and Flip Properties: Nevada mandated that at least half of the workforce at the Tesla gigafactory needs to be Nevada residents. The other half will need a place to call home! Assume that much of the other half will be higher level engineers, scientists and inventors. While Reno is striving to offer the best in Sciences and Engineering education, the Tesla factory will need the best of the best in 5-6 years. Look at properties with that timeline in mind. What improvements can be made to a property with a 5 year budget, and with a tenant in place for much of that time? Look for neighborhoods with artists and innovators; neighborhoods that are just starting to show improvement is where you'll find the bargains. Start your improvements on the exterior of the property to further advance the revitalization of the neighborhood. Property Management: Let the professionals do the day-to-day maintenance and management of your property. It is going to take 5-10 years before we experience the influx of revenue and jobs that Tesla promises. If you are living out of state, there's no reason to take on the hassle of managing your new Reno real estate. With a 5-10 year timeline, it's time to get comfortable, and we can help! With our proven track record of filling vacancies and maintaining properties, Clark Real Estate can turn your real estate investing dream into a reality. “The present is theirs; the future, for which I really worked, is mine.”

― Nikola Tesla There's a spark, a current, of electricity and excitement in the Reno air as business owners and property owners imagine the possibility of the Tesla Gigafactory coming to town. There is much discussion about state-offered incentives and benefits. Will it be approved? Will the benefits be worth it?

We think so. In real estate we see the value of new businesses infiltrating a city. We see how home values go up as the supply of inventory is more in demand. Further, we see how new companies bring in new revenue, that is spent in local restaurants, boutiques and salons. New money helps the local economy, and new people bring a sort of awakening to a community. We've noticed how new energy invigorates a neighborhood. New and improved landscaping, fencing and front doors suddenly dot a once rundown street. At Clark Real Estate, we are excited about the possibilities of co-branding with the legendary Tesla. Nikola Tesla* was an underdog who never gave up on his dreams. Reno has been coined an underdog, and now it doesn't have any excuses to give up on a brighter future. Engineer and physicist Nikola Tesla (1856-1943) made dozens of breakthroughs in the production, transmission and application of electric power. He invented the first alternating current (AC) motor and developed AC generation and transmission technology. Though he was famous and respected, he was never able to translate his copious inventions into long-term financial success—unlike his early employer and chief rival, Thomas Edison. [History.com]

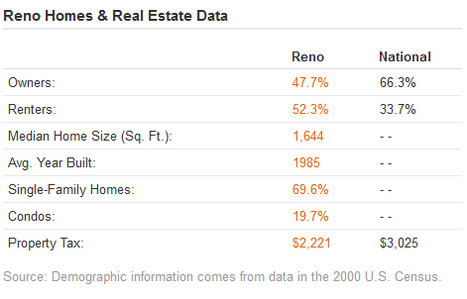

Reno is a great place to own a rental property (or two or three). Over half of Reno's population lives in a rental unit vs. their own home. Since the economic collapse in 2008, Reno's renter market has changed from short-term tenants to ex-homeowners. “Everyone’s doing it”—renting, that is! That means it’s a great time to have this hot commodity! Our three and four bedroom rentals are the first to fill up. If you're looking to purchase another investment rental property, we recommend buying a house with as many bedrooms and bathrooms as possible. Look for new construction or plan to do a full renovation. Clark Real Estate is a full-service real estate investment agency offering assistance in purchasing and property management of your investments! |

Clark Real Estate

305 W. Moana Ste C Reno, NV 89509 (775) 828-3355 Reno Property Management

All

|

RSS Feed

RSS Feed